Reimbursable Amount For Automobile Adaptive Equipment

These disabilities must be the result of an injury or disease.

Reimbursable amount for automobile adaptive equipment. Amounts authorized for reimbursement for new vehicles are to reflect the vha directive in effect at the time of purchase. According to advice by the office of general counsel va does not have the authority to pay for such costs allowable in obtaining adaptive equipment or the purchase price for the purchase of the automobile. The fiscal 2019 maximum amount was 21 058 69. Automobile adaptive equipment is used to permit physically challenged persons to enter exit and or operate a motor vehicle or other conveyance.

A certificate of eligibility for financial assistance in the purchase of one automobile or other conveyance in an amount not exceeding the amount specified in 38 u s c. It includes but is not limited to power steering power brakes power windows power seats and other special equipment necessary to assist the eligible person. A for the reimbursable amounts for automobile adaptive equipment from may 30 2006 until may 31. 3902 including all state local and other taxes where such are applicable and included in the purchase price and.

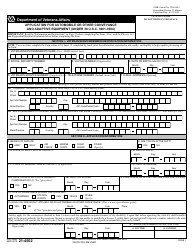

The department of veterans affairs automobile grant increased to a maximum of 21 488 29 effective oct. Complete va form 21 4502 application for automobile or other conveyance and adaptive equipment and mail to your regional office or. 1 for fiscal 2020. Including funding forms or process please see vha handbook 1173 4 automobile adaptive equipment program.

3 808 automobiles or other conveyances and adaptive equipment. Prorated by reducing the standard equipment reimbursable amount for like items by 10 per year this includes any add on adaptive equipment previously installed maximum deduction of 90 of the new reimbursement rate will be allowed for vehicles 10 years or older vehicles will have a residual value of 10. Can a veteran receive financial assistance from va to purchase an automobile. To support a claim for adaptive equipment the evidence must show that you have a disability as shown above or you have ankylosis of at least one knee or one hip due to service connected disability.

Prorated by reducing the standard equipment reimbursable amount for like items by 10 per year this includes any add on adaptive equipment previously installed maximum deduction of 90 of the new reimbursement rate will be allowed for vehicles 10 years or older vehicles will have a residual value of 10. Veteran or service members with certain disabilities can receive a grant to purchase a new or used vehicle.

.aspx?width=500&height=334)